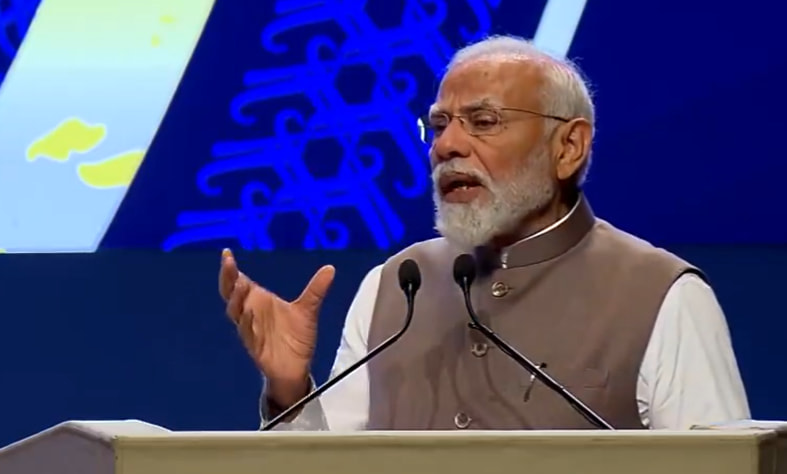

The Reserve Bank of India (RBI) marked its 90th anniversary with a keynote address by Prime Minister Narendra Modi. The Prime Minister used this occasion to shed light on the government’s financial reform strategy and the measures implemented to strengthen Public Sector Banks (PSBs).

PM Modi detailed the government’s strategy of “recognition, resolution, and recapitalisation.” He pointed out that the government has injected a significant capital of Rs. 3.5 lakh crores into the banking sector to improve the health of PSBs.

Alongside capital infusion, the government has introduced several governance-related reforms. These reforms are designed to increase operational efficiency, promote transparency, and ensure accountability within the banking sector.

A cornerstone of the government’s financial reform strategy is the introduction of the Insolvency and Bankruptcy Code (IBC). The IBC has been instrumental in resolving loans to the tune of around Rs. 3.25 lakh crores. It has provided a systematic and effective mechanism for dealing with insolvency and bankruptcy cases, thereby contributing to the cleanup of the banking system.

The 90th anniversary of the RBI served as a stage for the Prime Minister to underscore the government’s commitment to financial stability and economic growth. As the RBI steps into its 90th year, the focus remains on strengthening the financial sector and fostering a robust economy.